An Open Letter to the Political Class

George H. Blackford

September 3, 2018

On the Need to Raise Taxes

Grover Norquist founded Americans for Tax Reform (ATR) in 1985, a conservative advocacy group dedicated to the proposition that since the “government's power to control one's life derives from its power to tax” the power to tax should be minimized. This group “opposes all tax increases as a matter of principle” with the stated goal, according to Norquist, of reducing “government to the size where we can drown it in a bathtub.” In furtherance of this goal, ATR requires that any politician who seeks its support sign a pledge to “oppose and vote against any and all efforts to increase taxes.” The overwhelming majority of Republican politicians in the U. S. House and Senate have signed this pledge since it was instituted 1986, and Democrats have refused to make this pledge a campaign issue.

The failure of Democrats to make this pledge a campaign issue has made it possible for Republicans to argue that Americans are overtaxed and that all we have to do to provide the government we need is to lower taxes and eliminate government regulations and waste. This argument has stood essentially unchallenged at the center of the American political zeitgeist for well over thirty years now, and the extent to which politicians have come to embrace it is truly terrifying. This is particularly so when you stop and think about what Norquist is saying when he says he wants to drown the government in a bathtub. He’s saying that he wants to destroy the American government! The idea that we can save the country by destroying the government is utterly absurd on its face and totally out of touch with reality. And, yet, Norquist and his conservative friends, with the acquiescence of liberal/progressive Democrats who refuse to make this pledge a campaign issue, are well on their way to accomplishing this end.

When we leave the delusional world of Norquist and his conservative supporters and look at the way in which government actually determines the wellbeing of society in the real world we find that it is only those countries that devote a major portion of their economic resources to funding government services (e.g., the countries of Western Europe and North America) that are the most prosperous throughout the world:

Tax Revenues of OECD Countries as a % of GDP, 2016

Denmark

45.9

Greece

38.6

Czech Republic

34.0

Latvia

30.2

France

45.3

Norway

38.0

Poland

33.6

Australia

28.2

Belgium

44.2

Germany

37.6

Spain

33.5

Switzerland

27.8

Finland

44.1

Luxembourg

37.1

UK

33.2

Korea

26.3

Sweden

44.1

Slovenia

37.0

Slovak Republic

32.7

USA

26.0

Italy

42.9

Iceland

36.4

New Zealand

32.1

Turkey

25.5

Austria

42.7

Estonia

34.7

Canada

31.7

Ireland

23.0

Hungary

39.4

Portugal

34.4

Israel

31.2

Chile

20.4

Netherlands

38.8

Mean OECD

34.3

Japan

30.7

Mexico

17.2

Source: OECD Revenue Statistics (Comparative Tables).

and those that fail to do this (e.g., those countries that devote a smaller proportion of their GDP to their central governments than does the United States) are among the least prosperous:

National Government Taxes and Other Revenues as a % of GDP

USA

17.2

Uganda

15.2

Costa Rica

14.0

Korea, North

11.4

Guinea

17.0

Sri Lanka

15.1

Philippines

13.9

Timor-Leste

11.0

Cameroon

16.8

South Sudan

15.0

Burma

13.8

Bangladesh

10.8

Papua New Guinea

16.7

Suriname

14.9

Yemen

13.5

Turkmenistan

10.6

Curacao

16.6

Liechtenstein

14.9

West Bank

13.4

India

10.2

Malaysia

16.5

Pakistan

14.9

Indonesia

12.9

Afghanistan

9.5

Taiwan

16.3

Egypt

14.7

Madagascar

12.2

Puerto Rico

9.0

Bahrain

16.1

Monaco

14.6

Chad

12.1

Sudan

6.9

Tanzania

15.3

Benin

14.6

Brunei

12.0

Syria

4.2

Ethiopia

15.2

Isle of Man

14.6

Guatemala

11.8

Nigeria

3.5

Source: CIA World Facebook (Taxes and Other Revenue)

Countries that pay higher taxes than we do devote a larger portion of their economic resources to providing government services. Not surprisingly, these countries have longer life expectancies, healthier populations, lower crime and incarceration rates, better educated populations, higher standards of living, lower poverty rates and better public infrastructure. That is, they do a better job of “promoting the general Welfare” than does the United States. (Cf., OECD Comparative Tables.)

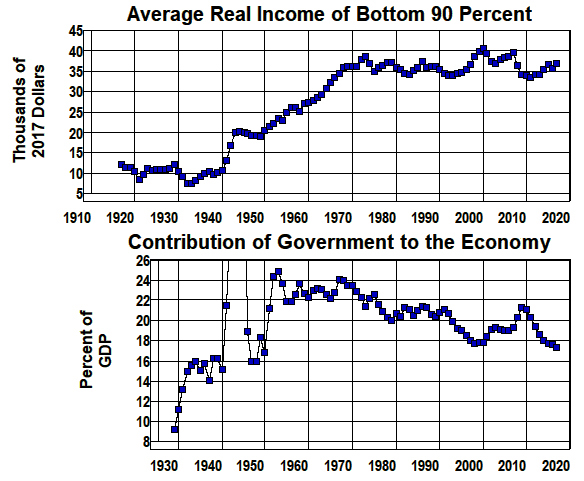

We find similar results when we look at the economic history of the United States since the beginning of the 20th century. There was virtually no increase in the average real family income of the bottom 90 percent of the population until the contribution of government to GDP increased from 9 percent in 1929 to to 24 percent by 1970. The average family income of the bottom 90 percent measured in 2017 prices increased dramatically during this period from a low of $7,500 per year to $36,200:

Source: The World Inequality Database and Bureau of Economic Analysis, Table 1.1.5

Taxes were high throughout this period as the personal tax rate in the top bracket was 91 percent and the corporate tax rate was 52 percent from the end of World War II until 1966. Conversely, we find that the average real income of the bottom 90 percent stagnated as taxes were cut and the contribution of government to GDP fell from 24 percent in 1970 to 17 percent in 2017. It was during this period of wage stagnation that fraud and predation flourished with the junk-bond/savings-and-loan frauds of the 1980s, the tech-stock/telecom frauds of the 1990s, and subprime-mortgage fraud of the 2000s as ordinary people were driven deeper and deeper into debt, and trillions of dollars were transferred from the victims at bottom to the predators at the top.

The simple fact is, Grover Norquist and his Republican allies, along with their Democratic enablers, are not simply destroying our government; they are destroying our country and everything our country used to stand for. And they are doing this in the name of a warped sense of freedom and liberty—the freedom and liberty of the economically and politically powerful to prey on the economically and politically weak by way of fraud and corruption throughout the system.

The ATR is absolutely correct when it says the “government's power to control one's life derives from its power to tax.” Only a democratically elected government that is truly dedicated “to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity” can control the lives of those who, through fraud and corruption, chose to prey on the less powerful among us.

And that government is not free! It must be paid for, and the way we pay for government is by paying taxes.

The alternative to paying taxes is for the populace to arm as it splinters into tribal factions in the manner of third-world countries that fight over the spoils of what is left of society as their governments disintegrate. This is, of course, what the Republican Party and its NRA supporters with its Russian backers are, wittingly or otherwise, advocating. It is also what its Democratic enablers are allowing to happen as well. And this is where we are headed if our political leaders continue to refuse to speak truth to power by explaining to the American People the actual fiscal choices that are available to us.

The idea that we can eliminate a 16 percent deficit hole in the federal budget and, at the same time, provide the kind of functioning government that the American people expect and need to prosper without raising the taxes that are necessary to pay for that government is patently absurd:

Source: Office of Manage and Budget (Historical Tables)

Even a casual examination of this chart reveals that it is impossible to maintain the government the vast majority of the American people want and, at the same time, eliminate the deficit through spending cuts. Where are these cuts supposed to come from? From eliminating waste, fraud, and abuse? The idea that we can reduce the federal budget 16 percent by eliminating waste, fraud, and abuse only makes sense to those who refuse to look at the numbers or are innumerate.

The only way the actual fiscal choices that are available to us can be made clear to the American people is if those political leaders who are capable of a modicum of common sense and human decency muster the courage to put country before donors, take a stand on this issue, and explain these choices to the American people in a way that allows the American people to choose at the polls which option they wish to follow:

a) increase taxes, or

b) cut Social Security, Medicare, Medicaid, defense, education, police and fire protection, highway and bridge maintenance, food and drug protection, water and waste treatment, consumer and environment protection, public health programs, and countless other government functions—cuts that will inevitably lead to a failed government that continues to ignore the will and needs of the people, promotes civil unrest and repression, and serve only the ideological delusions of the economically and politically powerful few.

Not giving the American people this choice ensures the latter option and does not bode well for the future.

References:

Who Needs Big Government? (Video)

A Day in Your Life: How Government Improves Your Life

Waste, Fraud, and Abuse in the Federal Budget

If you agree with this essay please pass it on, post a link to it ( http://www.rweconomics.com/htm/OLPC.htm ) on Facebook and other websites, and download a PDF of this essay ( http://www.rweconomics.com/htm/OLPC.pdf )

print it out, and send a copy to your senator and congressional representative.If you do not agree with it then please read it again and again until you figure it out, come to your senses, agree with it, and then pass it on.

This isn’t rocket science.

It’s just plain common sense!