Chapter 7: Rise of the Shadow Banking System (2014)

As memories of the Great Depression faded, an antigovernment movement began to take hold in the United States led by a group of people who possessed an abiding faith in the efficacy of free markets to solve all economic problems. This movement became the foundation of the Conservative Movement in the 1960s and, in turn, provided the ideological foundation of the Republican Party in the 1970s. Their mantra of lower taxes, less government, and deregulation combined with disdain for government has dominated the political debate ever since. These ideas were in the forefront of the Reagan Revolution that began with the election of Ronald Reagan in 1980, and, as was noted in Chapter 4, they were embraced by the Democratic Party in the 1990s. They reached a crescendo in the 2000s after the Republican Party took control of both the Whitehouse and Congress in 2000. (Harvey Frank Amy Westen Altemeyer)

The success of the Conservative Movement over the past thirty-five years in undermining the regulatory framework setup in response to the disaster that followed in the wake of the Crash of 1929 has been phenomenal—not only in passing legislation that deregulated our financial institutions but in reducing the funding for regulatory agencies and in fostering a non-enforcement attitude toward existing regulations as well. At the same time, changes took place in our financial system that made what was left of our regulatory system in the early 2000s essentially unworkable.

Deregulation in the 1980s

It was clear in 1980 that thrift institutions (i.e., savings banks and savings and loan associations) were in serious trouble as a result of the rise of Money Market Mutual Funds (short-term mutual funds with all of the characteristics of a savings account) and Cash Management Accounts (money market funds that allowed customers to withdraw their funds by writing a check) in the 1970s. Even though these funds were uninsured, the high interest rates in the late 1970s caused by the high rate of inflation during that era allowed money market funds to invest directly in Treasury securities backed by the full faith and credit of the federal government as well as in highly rated corporate debt and still pay a higher rate of interest to investors than was available on the regulated accounts at banks. Thus, given the high quality of their investments, money market funds did not have to be insured to compete directly with the insured deposits of banks, and the resulting loss of deposits to money market funds put depository institutions in a serious bind.

At the same time there was a second change in the financial system that was having a negative effect on banks, namely, the development of the market for Repurchase Agreements—a collateralized loan agreement wherein the borrower sells a security to a lender with the understanding that the borrower will buy it back (i.e., repurchase it) on a specific date at a higher price, the difference in price being the interest earned by the seller/lender. (FRBNY FDIC)

The market for repurchase agreements (and money market funds to the extent they invested in short-term corporate debt) competed directly with banks for their short-term loans. This was so because the existence of an efficient market for repurchase agreements gave large depositors at banks the choice of leaving their unused balances in non-interest earning checking accounts or earning a return on these balances by lending them out for short periods of time, even as short as overnight, in the repurchase market. Borrowers in these markets, thus, had a choice of borrowing for short periods of time either from a bank or from its depositors.

By 1980 it was felt that something had to be done about money market funds and repurchase agreements—that either these markets had to be regulated in such a way as to keep them from competing with banks, or banks had to be deregulated. In the deregulatory spirit of the times, this led to passage of the Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA) which authorized Negotiable Order of Withdrawal (NOW) and Automatic Transfer System (ATS) accounts that effectively allowed banks to pay interest on their checking accounts and write checks on their savings accounts. At the same time DIDMCA provided a mechanism by which interest rate ceilings on time deposits (savings accounts and certificates of deposit) would be phased out by 1986, and there was an expansion in the kinds of loans and investments that thrifts were allowed to make. This act also increased the insurance on deposits from $40,000 to $100,000. (FDIC)

While DIDMCA act allowed banks, in effect, to pay interest on their checking accounts and write checks on their savings accounts, and, thus, to compete with money market funds for deposits, it left the repurchase agreement market completely unregulated and the money market funds almost so, and it did little to solve the immediate problem of these institutions drawing off funds from banks, especially thrifts. Thrifts held long-term assets, mostly mortgages, that paid fixed rates of interest. They could not increase the interest rates on their deposits to match the rates offered by money market funds without losing money. At the same time, when market rates go up, the values of assets that pay fixed rates of interest go down. Thus, as thrifts lost deposits to money market funds they were forced to sell off their long-term assets at a loss to fund the withdrawals of their depositors.

By 1982 thrifts were in serious trouble as a result of the economic recession and the high interest rates caused by the anti-inflationary policies of the Fed. In response the Garn–St. Germain Depository Institutions Act of 1982 was passed to further deregulate banks. This act 1) lessened the capital and reserve requirements of banks, 2) provided mechanisms to assist failing banks rather than closing them, 3) accelerated the phase out of interest rate ceilings, and 4) further expanded the kinds of loans and investments thrifts could make so as to allow them to become more like commercial banks that were fairing much better in the financial turmoil of the times than were thrifts. (FDIC) It also allowed banks to offer interest-only, balloon-payment, and adjustable-rate (ARM) mortgages. In addition, in the years that followed, the Federal Reserve and the Comptroller of the Currency (the chief regulator of national banks) further relaxed the restrictions on the kinds of loans banks could make and allowed the non-bank subsidiaries of bank holding companies to buy and sell securities, such as derivatives, that they had previously been barred from holding. (FCIC)

It was thought that increasing competition in the financial sector by allowing thrifts to become more like commercial banks, and allowing thrifts and commercial banks greater flexibility in competing with mutual funds and in the market for repurchase agreements, the system could be made stronger and more efficient. All that was needed to bring this about was stable or declining interest rates to relieve the pressure on the solvency of thrifts. Interest rates did continue to decline as hoped, but, unfortunately, the deregulatory provisions of these two acts in the hands of the free marketeers of the Reagan Administration led to an unmitigated disaster.

The free-market philosophy of Reaganomics called for less government intervention in the market place. The idea was to get the government out of the way and just let the market sort things out as these institutions competed their way out of the problems they were in. The result was a reduction in the budgets and staffs of the regulatory agencies. This led to less examinations and regulatory supervision at these institutions at a time when the thrift institutions were in financial difficulty and attempting to expand their operations into new areas. (FDIC Black)

As was noted in Chapter 1, the result was the savings and loan crisis that began in the late 1980s—the first financial crisis to hit the United States since the Crash of 1929. In the end, some 1,300 savings institutions failed, along with 1,600 banks, a total that, ironically, was greater than the 2,800 institutions newly chartered under the policy that led to this crisis. In addition, some 300 fraudulently run savings and loans that were nothing more than Ponzi schemes failed at the peak of this disaster, over a thousand individuals associated with the savings and loan debacle were convicted of felonies, and it costs the American taxpayer $130 billion to clean up the mess. In addition, this financial crisis was a precursor to the 1990-1991 recession. (Black FDIC Krugman Akerlof Stewart)

The decision to deregulate the banking system in the face of the competition from money market funds and the markets for repurchase agreements in the early 1980s, rather than to expand the regulatory system to bring these funds and markets under the umbrella of the existing regulatory system, had profound effects on the financial system that went far beyond the savings and loan crisis. In understanding these effects it is instructive to review how financial markets are organized and to examine the kinds of financial instruments that are traded in these markets. It is also necessary to look at the role collateralization plays in today’s financial system.

Financial Markets and Instruments

The financial system is generally broken down into two markets: The capital market which is concerned with long-term financing for periods of more than a year and the money market which is concerned with short-term financing for periods less than a year.

The Capital Market

Stocks, bonds, and mortgages are sold in the capital market where Stocks are certificates of ownership of a corporation that give the holder a say in the management of the corporation and a right to its equity and profits. More simply put, the stock holders are the owners of the corporation.

A bond is a long-term financial instrument that defines the terms on which the issuer—a government or a corporation—agrees to borrow money. A bond generally has 1) a face value that defines how much the issuer (borrower) will pay the holder (lender) when the bond matures, 2) a maturity date that defines when the issuer will pay the holder the face value of the bond, and 3) an amount of interest and the terms, usually quarterly or biannually, on which interest will be paid to the holder of the bond.[34]

Bonds may or may not be backed by collateral. If a bond is backed by collateral it is a collateralized bond and the bondholder has a right to the collateral in the event the issuer defaults, that is, fails to live up to the terms of the bond. If a bond is not backed by collateral it is an uncollateralized bond. In the event of a bankruptcy the holder of an uncollateralized bond has a claim against whatever is left over after the collateralized creditors have claimed their collateral. Stock holders, being the owners of the corporation, are entitled to whatever is left, if anything, after all of the creditors are paid.

A mortgage loan is essentially a collateralized bond where the collateral is real estate owned by the issuer of the mortgage.

The Money Market

There are a number of financial instruments—generally referred as "paper"—that are bought and sold in the money market, the most important being:

1. Brokered Certificates of Deposit which are fixed term time deposits issued by banks and sold by brokers such as Merrill Lynch.

2. Repurchase Agreements which are collateralized loan agreements wherein, as was noted above, the borrower sells a security to a lender with the understanding that the borrower will buy it back (i.e., repurchase it) on a specific date at a higher price, the difference in price being the interest earned by the lender. If the borrower defaults the lender can keep or sell the security.

3. Commercial Paper which are promissory notes (i.e., IOUs) issued by corporations with strong credit ratings. Commercial Paper may or may not be collateralized. If the borrower defaults the lender has a right to the collateral if the paper is collateralized. Otherwise the lender is a lesser creditor in the event of bankruptcy.

4. Bankers' Acceptances which are a promise of a bank to pay a specified amount of money to the holder at a specified time and are generally used in international trade as a way to guarantee payment by a third party upon delivery;

5. Treasury Bills which are short-term government bonds with a maturity date less than a year.

6. Federal Funds which are the borrowing and lending of reserves between banks.

Importance of Collateralization

Before the development of markets for collateralized financial instruments, most long-term financing was obtained in the bond market by issuing uncollateralized bonds or through the mortgage market by obtaining a mortgage loan directly from a bank or an insurance company. By the same token, most short-term financing was obtained by borrowing directly from a bank.

As a result, virtually all financing was obtained in highly regulated markets from lenders who had a powerful incentive to examine carefully the credit worthiness of the borrower. In the case of uncollateralized bonds and unsecured loans, if the borrower defaulted and filed for bankruptcy the lender would get only what was left after the secured creditors claimed their collateral. In the case of mortgage loans, the lender would get the property secured by the mortgage, but there were costs involved, and if the value of the property fell the mortgagee stood to lose. In addition, the SEC, Fed, FDIC, and state banking and insurance agencies provided stability to these markets by overseeing them to prevent, as much as possible, recklessness and fraud on the part of borrowers and lenders.

With the rise of collateralized financial instruments the structure of the financial markets changed—at first gradually in the 1970s and 1980s and then explosively in the 1990s and 2000s.

Before the development of these instruments relatively few borrowers had access to the money market other than through a bank because lenders were unwilling to lend in this market to any but the most credit worthy borrowers. The reason was the lenders in this market were forced to take a close look at the creditworthiness of the borrower before they made a loan since they were unsecured creditors and at risk of a serious loss if the borrower defaulted. Only banks had the kind of personal contact with their borrowers to effectively evaluate the creditworthiness of most borrowers.

When the loan was collateralized the focus shifted from the creditworthiness of the borrower to the quality of the collateral since the fact that the loan was collateralized meant the potential loss to the lender in the event of a default was reduced by the value of the collateral underlying the loan. The development of collateralized financial instruments gave lenders a greater feeling of confidence in making short-term loans to borrowers they had shunned in the past because it was much easier, or so it seemed, to evaluate the value of the collateral underlying these loans than to evaluate the creditworthiness of a borrower that the lender did not know personally. This allowed borrowers to have access to the short-term money market that had never had access to this market before, and it allowed them to finance their operations in ways not available to them before.

For example, before the development of the market for collateralized commercial paper finance companies had to go to the capital market or a bank to borrow in order to relend to its customers. With the development of the market for collateralized commercial paper these companies had the option of setting up a company referred to as Special Purpose Vehicle (SPV) for the specific purpose of providing a conduit to secure financing in the Asset-backed Commercial Paper (ABCP) market. They did this by selling their loan contracts to the SPV (Special Purpose Vehicle) which, in turn, put these assets in a trust pledged as collateral against the commercial paper issued by SPV. The SPV's commercial paper could then be sold in the ABCP market and the proceeds used to pay the finance company for the loan contracts. What's more, the finance companies discovered that the shorter the term of the collateralized commercial paper the SPV issued, the lower the interest they had to pay. This meant they had to roll over their debt more often—that is, issue new paper to pay off their old paper as it came due—but they could make more money by financing their operations by going to the money market in this way than by going to banks or the capital market.

Not only did finance companies find they could increase their profits by financing their operations in the money market, private investment companies—better known as hedge funds—also found that they could increase their profits by going to the money market as well. Before the advent of the market for repurchase agreements, hedge funds were limited in their investments by their owners' funds and whatever funds they could obtain in the capital market through the sale of uncollateralized bonds and what they could borrow from banks. With the market for repurchase agreements they found they could fund their operations by entering into repurchase agreements for the assets they purchased, and, in so doing, they could borrow more than they were previously able to borrow and at lower rates of interest—again, the shorter the term of borrowed funds, the lower the interest they had to pay. This meant they also would have to roll over their debt more often, but, again, they could make more money by financing their operations this way than by going to banks or the capital market.

In addition to finance companies and hedge funds, investment banks such as Bear Stearns, bank holding companies such as Citigroup, and non financial companies such as Enron and Global Crossing found it profitable to create their own conduits to the short-term money market to fund their operations. These conduits took the form of SPVs that had two things in common with the examples given above: The first is that they made it possible to take advantage of the money market to secure short-term financing for long-term assets. The second is that since SPVs are not publicly traded companies and are not banks, they are outside the purview of the SEC and bank regulators. This second point is particularly relevant to bank holding companies and investment banks because they were allowed to structure their conduits in such a way as to take their long-term assets and the mechanism by which these assets were financed off their books and thereby avoid the scrutiny of their regulators. It was also particularly relevant to companies like Enron and Global Crossing and for the same reason except it was the scrutiny of their creditors and stockholders these companies sought to avoid.

The Shadow Banking System

Money market funds, hedge funds, finance companies, investment banks, bank holding companies and the SPVs that various institutions sponsor are part of what is referred to as the Shadow Banking System because they operate in the same way as regulated depository institutions in that they use short-term liabilities to finance the purchase of long-term assets, yet they fall outside the system of depository regulation. Since these institutions were less regulated than depository institutions, and there were no regulatory agencies that oversaw the SPVs these and other institutions sponsor, the only limitation on the amount of leverage shadow banks could create through their SPVs was the margin requirement placed on them by their creditors. This requirement is referred to as the haircut in financial circles, and it is the difference between the value of a loan and the value of the collateral put up to secure the loan. The margin (haircut) is generally expressed as a percentage of the collateral: A 5% margin means that the lender is willing to loan 95% of the value of the collateral. (Perotti)

The margin requirement limits the amount of leverage the borrower can obtain from a loan in that, unless the borrower is able to fund the margin through some source of unsecured credit, the only way the margin can be financed is through the borrower's equity (i.e., net worth). If, for example, the margin is 20% and the borrower wishes to purchase an asset worth $100 and use that asset for collateral, the lender will only lend $80 on the collateral underlying the loan. Since the borrower has to come up with the other $20 of the asset’s value on his or her own in order to make the purchase, that $20 must come out of the borrower's equity (assuming the borrower cannot obtain unsecured credit to fund the remaining $20 needed to make the purchase). This limits the leverage created by the loan to 4 to 1. ($80/$20) By the same token, if the margin is 3 1/3% the leverage of the loan will be 29 to 1. ($96.666/$3.333)

The margin requirement also determines the extent to which the shadow banking system is able to finance the amount of money it can borrow as a result of the amount of money it lends. This is so because when a shadow bank purchases a security for $1,000 it is, in effect, lending that $1,000. The margin determines the amount of that $1,000 the non-shadow banks are willing to lend to the shadow banking system to finance the purchase—the smaller the margin, the larger the amount the non-shadow banks will be willing to lend and the larger the amount of borrowing the shadow banking system will be able to finance as a result of its own lending.

The process by which shadow banks increase the amount they can borrow by increasing the amount they lend is somewhat different than, though analogous to, the way this is accomplished by ordinary banks, and the end result is the same. When an ordinary bank makes a loan it does not know how much of the loan the non-bank public will return to the banking system through an increase in deposits and how much will leave the banking system (the margin) through an increase in currency in circulation. In addition, there is no reason to expect that the proceeds of the loan will be spent and redeposited in the bank that made the loan. It is most likely to be redeposited in some other bank.

The basic difference between a shadow bank that finances its operations in the market for repurchase agreements (or in the Asset-backed Commercial Paper market) and an ordinary bank that makes a loan is that the shadow bank knows the amount that will be lent back (the amount it is able to borrow to purchase a security) when it makes the loan (purchases a security), and this amount is lent directly back to the shadow bank that makes the loan (purchases a security) before the loan (security purchase) is actually made.[1]

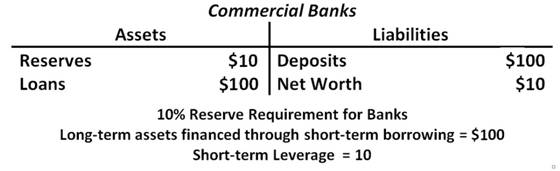

In order to appreciate the way shadow banks fit into the financial system, consider a situation in which there is a $50 billion monetary base in the economy, $40 billion of which is held as currency in circulation and $10 billion is held as reserves in the banking system. If the reserve requirement is 10% and there is $10 billion worth of equity in the banking system, the $10 billion worth of reserves can be lent and redeposited in banks 10 times until there are $100 billion worth of loans and deposits in the banking system in the manner indicated in Figure 7.1:

Figure 7.1: Loans and Deposits in the Banking System.

In this situation, the leverage in the Banking System that comes from Deposits will be 10 to 1 ($100/ $10) and there will be $100 billion of relatively long-term Loans financed by $100 billion worth of short-term Deposits.

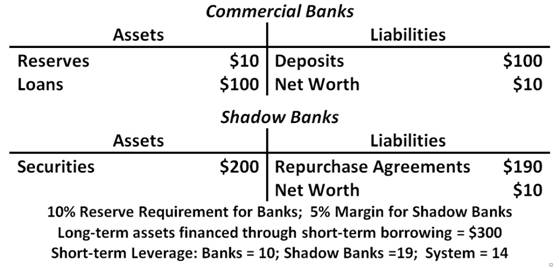

Now assume a shadow banking system exists that has $10 billion worth of equity and that shadow banks are able to borrow at a 5% margin through the use of repurchase agreements (or in the Asset-backed Commercial Paper market). In this situation, the shadow banking system will be able to expand the amount of money it is able to lend by purchasing $200 billion worth of Securities and financing that purchase by borrowing $190 billion in the market for Repurchase Agreements. The result is depicted in Figure 7.2 where it is assumed that the monetary base is unchanged and currency in circulation, Deposits, and bank Loans in Commercial Banks are unchanged as well:

Figure 7.2: Loans, Deposits, and Repurchase Agreements with a 5% Margin.

The total amount of long-term assets financed through short-term borrowing has increased from $100 billion to $300 billion as a result of the additional $200 billion worth of securities financed in the market for repurchase agreements. In addition, the leverage in the financial system as a whole that is created by short-term financing has increased from 10 to 1 ($100/$10) to 14 to 1 ($290/ $20) as a result of the 19 to 1 ($190/$10) leverage in the Shadow Banks.

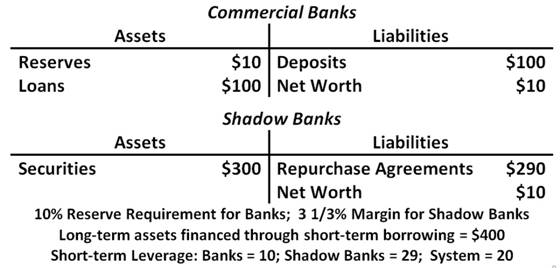

What if the margin is were 1/3%? Here we find that the $10 billion dollars worth of equity in the Shadow Banks would make it possible for $290 billion to be borrowed and $300 billion worth of securities to be purchased by the Shadow Banks. As a result, it would be possible for some $400 billion worth of assets to be financed by $390 billion worth of short-term borrowing within the financial system as a whole, and the leverage created by short-term borrowing in the financial system as a whole has increased to 20 to 1 ($390/$20) as a result of the 29 to 1 ($290/ $10) leverage of the Shadow Banks. This situation is shown in Figure 7.3:

Figure 7.3: Loans, Deposits, and Repurchase Agreements with a 3 1/3% Margin.

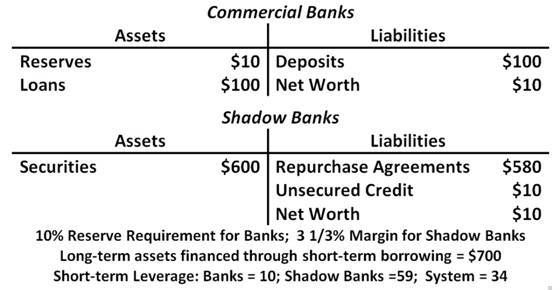

Finally, it should be noted that if shadow banks are able to obtain an additional $10 billion by way of unsecured credit (say, from its sponsor in the case of an SPV), the shadow banking system will be able to increase its borrowing by an additional $290 billion in the market for repurchase agreements and purchase an additional $300 billion worth of securities as a result. This situation is shown in Figure 7.4 where the total amount of loans financed through short-term borrowing and unsecured loans by Shadow Banks is increased to $600 billion; the leverage of the Shadow Banks is increased to 59 to 1 ($590/$10), and leverage in the financial system as a whole that is created by short-term and unsecured financing will increase to 34 to 1 ($690/$20):

Figure 7.4: Loans, Deposits, and Repurchase Agreements with a 3 1/3% Margin and $10 Billion in Unsecured Credit.

Here we have a situation in which a 1.7% decrease ($10/$600) in asset prices would wipe out the aggregate net worth of the entire shadow banking system, and a 3% decrease ($20/$700) would wipe out the aggregate net worth of the entire financial system.

At this point, the threat the shadow banks pose to the financial system and, indeed, to the economic system as a whole should be obvious. Shadow banks finance their operations in the same way banks finance their operations in that they borrow short term and lend long term. Thus, shadow banks are subject to the same kinds liquidity and solvency problems that ordinary banks are subject to. They are also subject to the same kinds of temptations to expand their leverage and to fund the same kinds of speculative activities that have wrought such havoc with the economic system throughout the history of banking.

At the same time, shadow banks function outside the financial regulatory system. Their short-term creditors are not insured by the FDIC. They cannot, in general, borrow from the Federal Reserve,[2] and they are extremely vulnerable to the kind of irrational panic that leads to a run. The only way they can meet the demands of their creditors in the face of a run is by selling their assets, and if they are forced to sell their assets in the midst of a crisis the prices of their assets are susceptible to the same kind of downward spiral the assets of nineteenth century banks were susceptible to—the kind of downward spiral in asset prices that followed the Crash of 1929 and led to the implosion of the financial system in the 1930s.

In addition, shadow banks are not constrained by the monetary base. They have no use for currency, either in the form of vault cash or as a deposit at the Federal Reserve, and the monetary base does not constrain the amount of long-term lending they can finance through short-term borrowing. As is indicated in the examples illustrated in Figure 7.1 through Figure 7.4 above, shadow banks can expand their lending even when reserves, deposits, and currency in circulation are fixed. The only constraints on their lending are 1) their equity, 2) the amount of unsecured credit they are able to obtain, and 3) the margin imposed by their creditors on the repurchase agreements they enter into and on the Asset-backed Commercial Paper they issue.

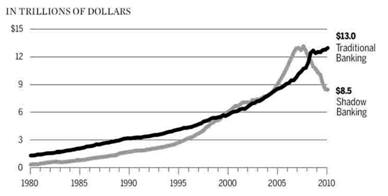

This would not be much of a problem if these institutions were relatively small and played a minor role in the financial system, but, as was noted above, and as is indicated in Figure 7.5, the growth of shadow banks was explosive in the 1990s and 2000s. The shadow banking system was, in fact, significantly larger than the traditional banking system by 2007 when the financial system began to breakdown. The asset-backed commercial paper issued by these institutions amounted to some $2.2 trillion in 2007, and the amount of money shadow banks financed overnight with repurchase agreements stood at $2.5 trillion. The assets held by hedge funds had grown to $1.8 trillion, and the assets held by investment banks had grown to $4 trillion—a major portion of which was financed through repurchase agreements. These numbers are to be compared to the total value of all of the assets held by the entire traditional banking system in 2007 which stood at $10 trillion. (Geithner) As is indicated in Figure 7.5, Shadow banks held well over $12 trillion dollars worth of assets in 2007.

Figure 7.5; Assets of Traditional and Shadow Banking System, 1980-2010.

Source: Financial Crisis Inquiry Report.

Far from being relatively small and playing a minor role in the financial system in 2007, shadow banks were huge and played a major role in this system. Shadow banks were the major borrower in the market for repurchase agreements, and the lenders in this market were pension funds, money market funds, mutual funds, large corporations, banks, insurance companies, local governments, and any other large institution that had excess cash in the bank on which it wanted to earn a return for a few days or weeks or even just overnight. Shadow banks owed money to literally everyone when the housing market reached its peak in 2006 and the system began to unravel in 2007. Anyone vested in a pension plan or who owned a mutual fund, a money market account, an insurance policy, or stock in a large corporation or bank was owed money by shadow banks when the run on the system began in the summer of 2007.

Endnotes

[1] Cf. Borio and Disyatat’s discussion of the elasticity of finance.

[2] Shadow banks could not borrow from the Federal Reserve at all until Section 13(3) (12 U.S.C. §343) of the Federal Reserve Act as amended in the Federal Deposit Insurance Corporation Improvement Act (FDI-CIA) of 1991 came into being. It was this section that legitimized the extraordinary actions taken by the Federal Reserve to prop up the finan-cial system from 2007 through 2009 that are chronicled in Chapter 10 below. (FRS)

[34] Notes are also traded in the capital market, but since the only difference between a note and a bond is that notes are shorter term (maturing in two to ten years) while bonds are longer term (maturing in excess of ten years) notes will not be discussed separately here.

[35] It should be noted reserve and capital requirements are not the same thing, and there is no reason the two requirements should be equal in the real world. A 10% capital requirement means that banks must have equity equal to at least 10% of their assets. A 10% reserve requirement means that banks must have reserves equal to at least 10% of their deposits. Capital requirements limit assets and are designed to enhance the solvency of banks. Reserve requirements limit deposits (a liability) and are designed to minimize the liquidity problem of banks. In addition, just as there are different reserve requirements for different kinds of deposits, there are different capital requirement for different kinds of assets.

The only reason it is assumed in this hypothetical example (and in the examples that follow) that the reserve and capital requirements are equal is to simplify the exposition in order to bring out the basic principles involved. See Feinman for a discussion of how reserve requirements are determined. The determination of capital requirements is explained in the 2002 Rule promulgated on November 29, 2001 by the OCC, FRS, FDIC, and OTS.